ALL THE RESOURCES YOU NEED

Whether it's your first year or your fortieth, we're here to support you.

Our program is designed to work "Full Circle" throughout any and every stage of serving your community.

This is only the tip of the iceberg!

As a member of our Full Circle coaching program, you will have instant and complete access to our full library of in-depth, ready-to-use resources, frameworks, and materials designed to help you make more money, find more meaning, and use your time the way you want.

FREE RESOURCES

Get instant access to some of our most popular tools for moving forward quickly.

"I downloaded the Family Referral Generator and started using it in February. I started closing my day 2 report with the offer of the “Family Wellness Checkup”. I then have my CA review our office policies that also includes the FWCU, she then hands them a envelope with the letter and coupons. In the month of March we increased $15k over our average and were going to do it again here in April."

-Dr. Glen in Alberta

Practice Plateau Quiz

Feeling stuck? Let's find out why...and what to do next.

Take this 60 second quiz to see how your thoughts and beliefs are dictating your daily actions and impacting your business results. There are 4 categories of “Success Mindsets”. Each mindset is neither good nor bad, right nor wrong… they just come with their own set of predictable outcomes.

Family Referral Machine

The "Family Magnet" System I Use To Turn Each New Patient into Four

Discover how to quickly talk to new patients about their family's health (without sounding salesy). This simple 3 step system allowed me to get entire households in care in the first month. I'll show you exactly how to bring in five new referrals each month with one piece of paper!

PREMIUM RESOURCES

Not ready to join our program? These complete packages will help you achieve one specific goal very quickly.

Associate Doctor Recruiting Program

Are you ready to hire an associate? Here's what to do.

Quite frankly, this is some great advice for anyone who is considering having an associate doc now or in the future, or if you're considering becoming an associate. Clearly defined expectations in the form of a contract just make good sense... for both parties involved. It makes for a healthier relationship moving forward!

Practice Valuations

Stop wondering what it's worth and start planning for your next steps.

We have been providing professional, industry-leading valuations and appraisals for practices for more than 20 years. Using our proprietary formula, we are able to effectively build proper value in a successful practice.

Don't trust your life's work to an accountant's general formula. Work with us and get the value you deserve!

Discover Dr. Preston's New Books

Click the link below to view my Amazon Author page and see my latest publications.

The Latest from Our Videos

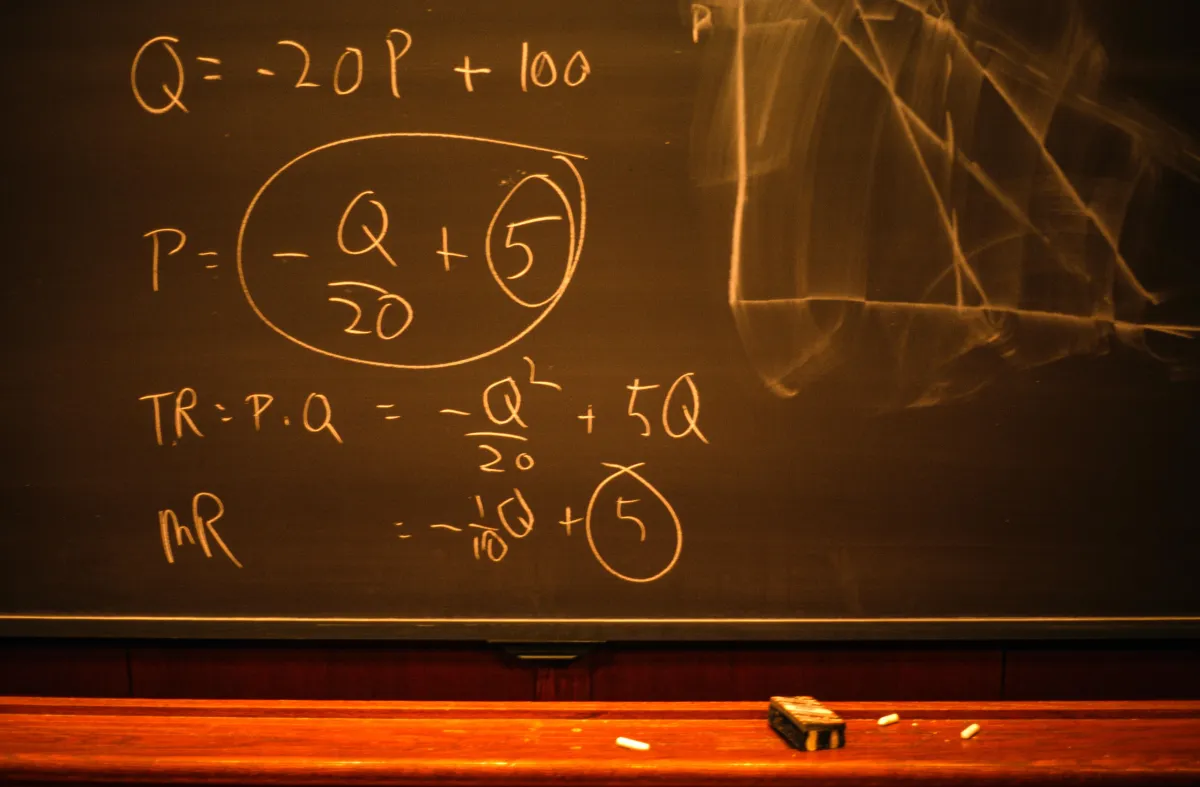

Chiropractor Tax Strategies 2025: Maximize Deductions

Take Control of Tax Season: Chiropractic Business Owners’ Guide to Financial Success

Tax season doesn’t have to be a source of stress. With the right strategy, chiropractors can maximize deductions, minimize tax liability, and position their practice for long-term financial success. Let’s break down how you can take control of your taxes with confidence.

1. Organize Your Financial Records Like a Pro

A well-organized financial system is the foundation of stress-free tax filing. Here’s what you need to keep track of:

✔ Income & Expenses – Keep accurate records of all revenue and business-related spending.

✔ Reconciled Statements – Ensure bank and credit card transactions match recorded expenses.

✔ Insurance & Patient Payments – Maintain clear documentation of claims and refunds.

✔ Expense Categorization – Properly label business costs to maximize deductions.

💡 Pro Tip: Use accounting software or outsource to a bookkeeper to streamline this process and eliminate tax-time headaches.

2. Claim Every Deduction You Deserve

Chiropractors often miss out on deductions that could save them thousands. Don’t leave money on the table—review these commonly overlooked write-offs:

💰 Office Costs – Rent, utilities, maintenance, and even home office expenses if applicable.

💰 Equipment & Supplies – Chiropractic tables, tools, and office furniture.

💰 Staffing & Training – Employee salaries, training programs, and professional development.

💰 Continuing Education – Licensing fees, seminars, and industry conferences.

💰 Marketing & Advertising – Website hosting, social media ads, and branding investments.

💰 Business Travel & Networking – Costs for attending events or meeting with industry peers.

📌 Action Step: Review last year’s expenses to see if you’ve missed any deductions.

3. Plan for Tax Payments & Avoid Surprises

Staying ahead of tax obligations can save you from financial strain and penalties. Here’s how:

📅 Set Aside Funds – Regularly save a portion of income to cover tax liabilities.

📅 Make Quarterly Tax Payments – If required, avoid large lump sums by paying estimated taxes throughout the year.

📅 Understand Healthcare Tax Laws – Stay informed about tax regulations specific to chiropractic businesses.

🚀 Pro Tip: Work with a tax specialist to ensure compliance and optimize your tax strategy.

4. Reduce Your Taxable Income with Retirement Contributions

Want to lower your tax burden while securing your financial future? Retirement planning is a smart move. Consider:

🏦 Registered Retirement Plans – Contributions to RRSPs, 401(k)s, or SEP IRAs.

🏦 Employer-Matching Opportunities – If you offer employee benefits, maximize your contributions.

🏦 Long-Term Financial Security – Investing now helps both your personal wealth and business stability.

5. Consult a Tax Professional for Maximum Savings

Even if you manage bookkeeping in-house, a tax expert can help:

✔ Identify healthcare-specific tax credits

✔ Ensure full compliance with evolving tax laws

✔ Develop a customized strategy to minimize future tax liability

📞 Need guidance? Let Full Circle Coaching help you navigate tax season with confidence!